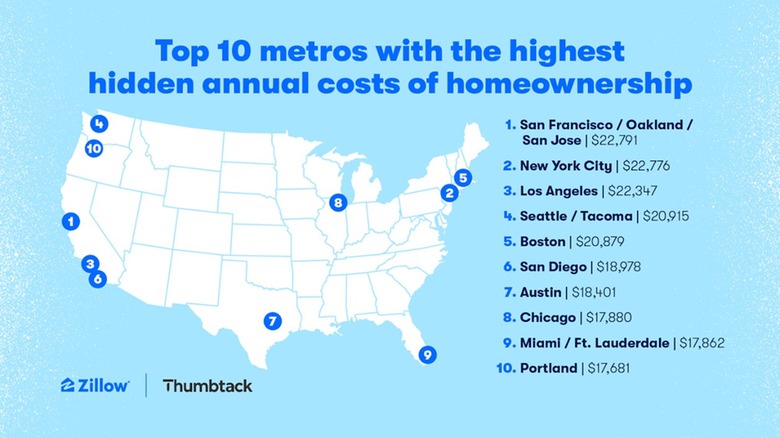

Homeowners Pay The Most Hidden Costs In This One City

Nothing can be more frustrating than discovering you're paying hidden costs. Whether it happens when buying concert tickets, checking into a hotel, or signing up for a gym membership, we hate seeing those extra charges pop up. Unfortunately, hidden fees are also a part of homeownership, and some places have it much worse than others. A new joint study by Zillow and home services app Thumbtack found that one city in particular has the highest hidden costs for homeowners.

Home insurance, property tax, and utility surcharges are just a few examples of these hidden costs that homeowners face, and the nationwide average annual cost of these hidden fees is just over $14,000. On average, that number works out to an extra $1,180 per month on top of your mortgage payment. However, in San Francisco, those same fees can reach a staggering $22,791, or almost $1,900 a month, according to the study.

In addition to the high cost of living in the city, homeowners must also contend with some of the highest property taxes and utility surcharges in the country. While hidden costs are a part of homeownership everywhere, San Francisco homeowners pay a particularly steep price to live in the city by the bay. Coming in at a close second and third, respectively, are New York City and Los Angeles.

Across 39 metro areas, the research specifically focused on three expenses single-family households pay: property taxes; homeowners' insurance; and utility payments, including energy, water, natural gas, and internet service. The study found that these expenses averaged $7,742 nationally. Unsurprisingly, New Yorkers pay the highest property taxes at upward of $9,000 per year, but in Hartford, Connecticut, utility payments cost the most, averaging $4,443 a year.

"Understanding all the costs that come with homeownership can not only impact a buyer's budget but the type of home they shop for too," Zillow home trends expert Amanda Pendleton said in a press release. "While a big backyard or a larger home may be appealing, it's important to consider how much maintaining those spaces could cost. Buyers may want to consider affordable alternatives to single-family homes or spend more up front on a new-construction home that could need less maintenance in the near term."

Elsewhere, the study showed that the metro area that paid the least in hidden fees was Las Vegas, Nevada, which came in at just under $10,000, meaning potential homeowners can finally call themselves big winners in Vegas.