This Is Currently The Cheapest State To Buy A House In

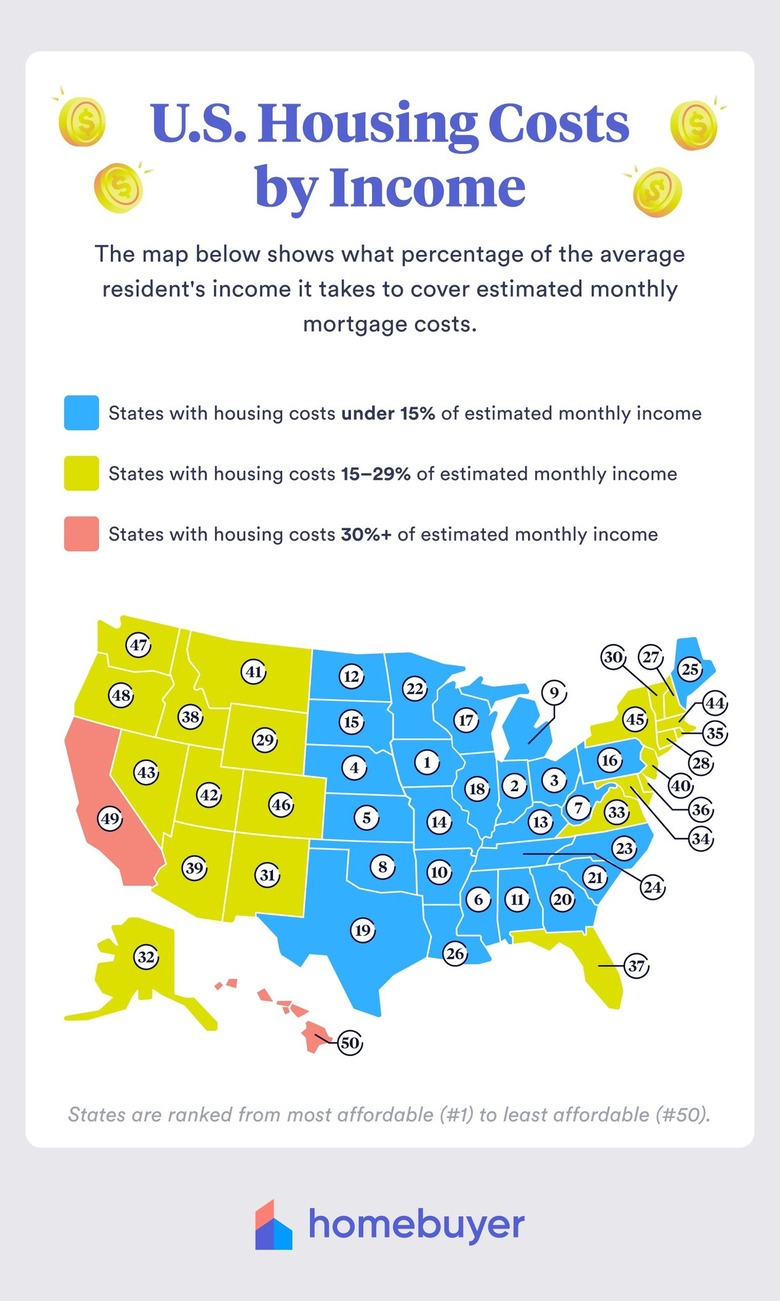

Between inflation and an overwhelming real estate market, buying a home during such financially challenging times is seemingly unattainable for many of us. However, signing a deed may be easier on your bank account in some states rather than others. A study conducted by homebuyer.com evaluated income data and home prices to determine which states it was cheapest to buy a house in this year.

Every state has unique property taxes and utilities, among other expenses, so there were a lot of varying factors to take into account here, but the study really focused on income to mortgage ratio. How much of a homebuyer's income will they spend on a mortgage payment? Well, the state with the lowest percentage is ... (drum roll, please!) ... Iowa!

The study shows that Iowa homebuyers will spend about 10.6% of their monthly income on their monthly mortgage payment, with the average home costing around $147,800. Following close behind Iowa are its midwestern neighbors, Indiana and Ohio.

Interestingly enough, after Hawaii was just crowned the happiest state in America, this study declared Hawaii to be the most expensive state to buy a house in, with new homeowners spending 35.15% of their monthly income on a mortgage payment. The average home price in Hawaii is around $615,300. Closely following Hawaii as the most expensive states to buy a home in are California and Oregon.

If you're in the market for a house, it seems like the cheapest states to plant your roots gear more towards the midwest and the south, away from both coasts. While all data is relative to your unique situation, it may be something to keep in mind while you're scouting Zillow for the latest listings.