This Study Shows That Women Have To Work More Than Men To Afford A Home

We wouldn't be the first to tell you that the current housing market is off the charts. Buying a house is expensive enough as it is, but there also aren't enough dwellings to meet the demand of prospective buyers. Well, imagine experiencing the struggle of landing your dream home, but then learning that the ordeal has actually been proven to be worse if you identify as a woman.

If you just did a double take, we wouldn't blame you. That's right: According to a new ConsumerAffairs study, for women, saving up to be a homeowner will take a longer period of time than it does for the average man.

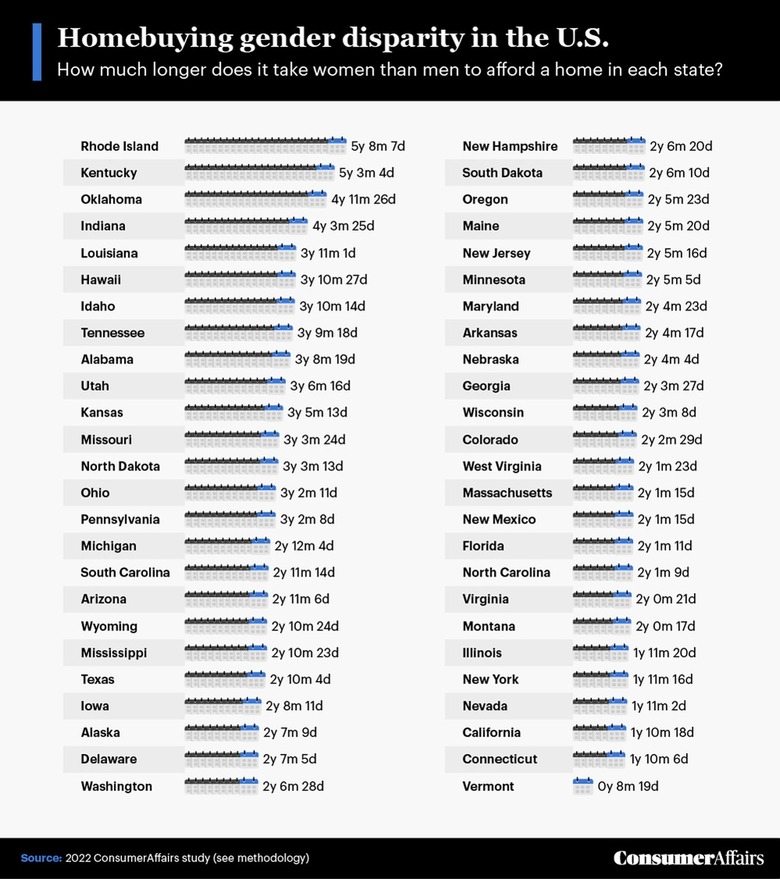

The team analyzed various studies surrounding income gaps between genders along with current housing costs to come up with some harrowing conclusions. They first looked at the median earnings for women in each state compared to the median down payment in each state. This data was combined with the national savings average for Americans.

The conclusions showed that Vermont is the easiest state for a woman to afford a home, while Rhode Island will be the most challenging. While in Vermont, it would take around 5 and a half years to save for a home, in Rhode Island, it could be close to 30 years before a woman can afford a house.

The research was repeated for men, and the findings were laid out side by side. The results revealed that Rhode Island, while the most difficult place to afford a home, also has the biggest gap in relation to the time necessary to save for a home. A woman would need to save for almost six years longer than a male counterpart in order to purchase property in that state.

While these findings are tough to take in, they serve as a reminder that even though women have come a long way in terms of equality, they still have such a long way to go. You can read the full study on the ConsumerAffairs website to learn more about these disturbing results, and read some advice from experts for women homebuyers.