How Long Does It Take To Close On A House?

Few things are as exciting for homeowners as their actual closing day, when the closing process becomes final, and it's time to move into their new home and start making memories. Scheduling a closing date may be particularly meaningful for first-time homebuyers who have never gone through the mortgage process. Even if this is not your first time navigating the ins and outs of a mortgage loan closing, you'll find that the nail-biting period between signing a contract on your new home and signing the closing documents may not match the same time frame as previous closings.

Tip

For most types of mortgage loans, the closing process from start to finish typically takes around two months.

Mortgage Closing Process Time Frame

Mortgage Closing Process Time Frame

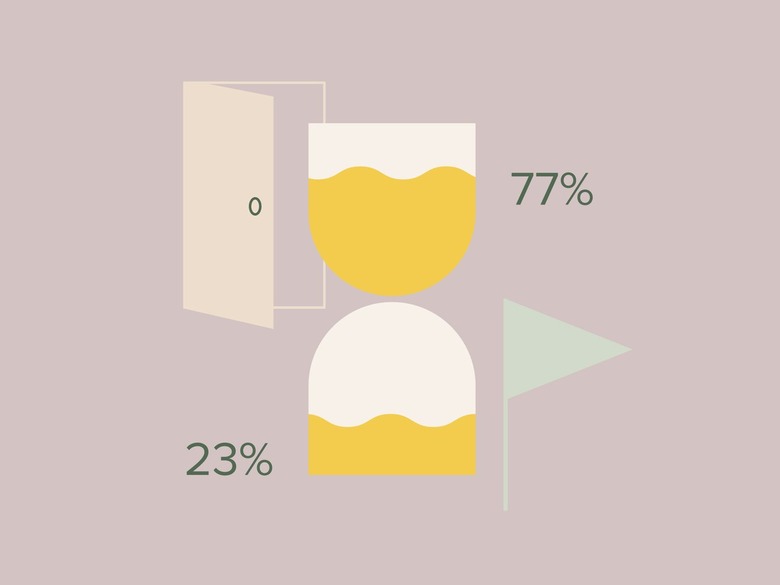

Most homebuyers use a mortgage lender to finance their home, which requires a longer closing process than when buying with cash. Zillow reports that closing times for the 23 percent of homebuyers who purchase with cash may be as short as seven days after signing the contract. The remaining 77 percent of homebuyers who finance their home purchase are looking at close to 60 days to complete the closing process.

The actual average for the number of days it takes to close on a mortgage loan is a moving target and is often highly variable, in part depending on the economy as well as the type of loan. Ellie Mae (recently acquired by ICE Mortgage Technology), a provider for the cloud-based platform that helps lenders facilitate mortgages from loan origination to final settlement, also analyzes mortgage data each year. Among other statistics, Ellie Mae's data reveals the average length of time it takes to close different types of mortgage loans.

For example, in December 2020, Ellie Mae reported that it took an average of 58 days to close a mortgage, with purchase loans averaging 56 days and refinances averaging 59 days. March 2020 saw the shortest closing average for the year (40 days), with purchase loans averaging 45 days and refinances averaging only 35 days.

The length of the closing process also depends on the type of mortgage loan. For example, in December 2020, a purchase loan took an average of 56 days to close, while a refinance took an average of 59 days. In the same month, Federal Housing Administration loans took an average of 62 days to close (61 days for a purchase loan and 64 days for a refinance), conventional home loans took an average of 57 days to close (53 days for a purchase loan and 59 days for a refinance) and Veterans Affairs loans took an average of 61 days to close (60 days for a purchase loan and 64 days for a refinance).

Two Phases of the Closing Process

Two Phases of the Closing Process

For many borrowers, particularly first-time homebuyers, the mechanics of the closing process can be a bit of a mystery because of so many things going on in the background. During this time, closely communicating with a real estate agent can help demystify the process. But it goes something like this:

- Once a buyer and a seller sign a contract,

also called a purchase agreement, this kicks off the first phase

—

escrow

—

which is the lengthiest part of the closing process.

- Escrow ends at the second

and last phase of the closing process, which is the actual closing day.

During escrow, earnest money (also called a good faith deposit, which is about 1-2 percent of the total loan amount) from the buyer is deposited into an escrow account where it's held until closing day. At closing, this earnest money is applied toward the buyer's closing costs. The purchase agreement outlines the conditions under which earnest money may be refunded to the buyer. Common reasons that earnest money may not be refunded is if the buyer simply changes their mind about the purchase or if the contract contingencies (such as an inspection or a title search) are not met within the specified time frame in the contract.

Mortgage Escrow Timeline

Mortgage Escrow Timeline

Once a buyer and seller sign a contract, a series of steps advances this escrow phase toward a successful closing date and reveals the true cost of buying a home. Each step in this closing process varies in the time it takes to complete, and some of the steps may occur simultaneously.

As a rule of thumb, some typical estimates for the time involvement that you can expect for some of the steps in escrow include:

- Completing the mortgage application (one day)

- Giving an underwriter (or an underwriting department) time to review and approve the application (five to 20 days)

- Scheduling and completing the home inspection and

performing any needed repairs to cure contingencies in the purchase contract

(one to two weeks) - Scheduling an appointment with a qualified appraiser and

waiting for the completed appraisal (one to two weeks) - Obtaining homeowners' insurance (required) and title

insurance (optional) — one day. (Even if a title search that's performed by a

reputable title company turns up a clear title in the Abstract of Title document, some homebuyers opt to get

title insurance to protect them against any unforeseen future ownership claims.)

Potential Closing Delays

Potential Closing Delays

It can be a tad frustrating to have your eye on a closing date only to have the date fall through. Closing delays can be the result of a number of potential problems, some of which are minor and easily cured, while others may require a little more work to resolve. Although you may have to reschedule your original closing date, you may still be able to walk away from the closing table with the keys to your new home in hand ... just a little later than you expected.

Some of the potential closing delays you may encounter include:

- Mortgage funding. As the ultimate bottom-line part of the

closing process, if financing falls through, you cannot finalize your mortgage

and obtain ownership. The good news is that funding glitches don't necessarily sound

kill the entire purchase, wrecking your homeownership dreams. - Credit issues. Even if your creditworthiness passed the

preapproval test, recent changes to your credit report may have adversely

affected your debt-to-income ratio. - Appraisal problems. As long as the appraised value of the

home is equal to or greater than the amount listed in your contract, you're

good to go. If the appraised value comes in lower, you still have options. You

may be able to renegotiate the terms of your contract or pay the difference between the appraised value and the agreed-upon sales price up front. - Title problems. If a title search turned up any potential

ownership claims from a party (or parties) other than the seller or if the

property carries any outstanding liens or judgments, you won't be able to

complete the closing process until these problems are resolved.

How to Avoid Closing Delays

How to Avoid Closing Delays

Although you cannot anticipate or even resolve all potential closing problems, there are steps you can take to avoid some of the common delays to the closing process.

- Get a mortgage preapproval. Before you start shopping for a new home — and especially before you have your heart set on that perfect house in the

neighborhood you want — get a preapproval for a mortgage. A better strategy is

to shop several lenders and obtain a preapproval from each of them. A

preapproval may also offer a rate lock, which will lock in mortgage rates

during a specified time. This way, if interest rates go up, you'll be

guaranteed the lower rate in your preapproval. - Avoid delaying your inspection. The best time to schedule a

home inspection is immediately after you've signed a contract. You want any

potential problems to present themselves early in the game before you've gone

too far into the closing process. - Work with a seasoned mortgage lender. By shopping around for

different lenders, you can get the best deal possible, but

you also want to work with a lender (or broker) who knows the ropes and

seamlessly guides you through the closing process. - Submit paperwork promptly. With a sea of documents typically required for a

successful loan closing, make sure that you submit each document that's

requested from you as soon as possible. If you need to update some

documents or provide additional documentation, immediately respond to these

requests so you don't delay your own closing process.